Global mobility gave transnational capital newfound structural power over nationally based working classes. Globalization and neo-liberal policies opened up vast new opportunities for transnational accumulation in the 1980s and 1990s. What took place, in broad strokes, during these decades? Privatizations facilitated a new round of primitive accumulation as public and community spheres were commodified and turned over to capital. These privatizations as well as the imposition of "intellectual property rights" opened up public sectors, community spaces, and cultural and knowledge production to commodification and hence facilitated new bursts of accumulation. Deregulation, liberalization, and free trade agreements allowed for a new wave of foreign direct investment, for a sharp increase in cross-border mergers and acquisitions, and for a heightened concentration and centralization of capital on a global scale. The incorporation of the former Soviet bloc and Third World revolutionary countries into global capitalism provided vast new markets and investment outlets. The introduction of computer and information technology (CIT) represented a new "Scientific and Technological Revolution" that triggered explosive growth in productivity and productive capacities, a disproportionate increase in fixed capital, and also the means for capital to go global - to coordinate and synchronize a globalized system of production, finances, and services, in distinction to a globalized market for goods and services that dates back centuries. The revolution in CIT and other technological advances helped emergent transnational capital to restructure, "flexibilize," and shed labor worldwide. New modalities for mobilizing and exploiting the global labor force included a massive new round of primitive accumulation and the uprooting and displacement of hundreds of millions of people, especially from the Third World countryside, who became internal and transnational migrants. These processes, in turn, undercut wages and the social wage and facilitated a transfer of income to capital and to high-consumption sectors around the world that provided new market segments fueling growth. Crisis theory suggests that new phases of capital accumulation come on the heels of crisis and involve the introduction of technological innovations that become the leading edge of renewed rounds of accumulation. This certainly seems to be the case with regard to the generalized introduction of CIT in the wake of the 1970s crisis. Whether nanotechnology, bioengineering, 3-D printing manufacturing, or some other emerging technology will become a new leading edge of accumulation in the wake of the current crisis remains to be seen.

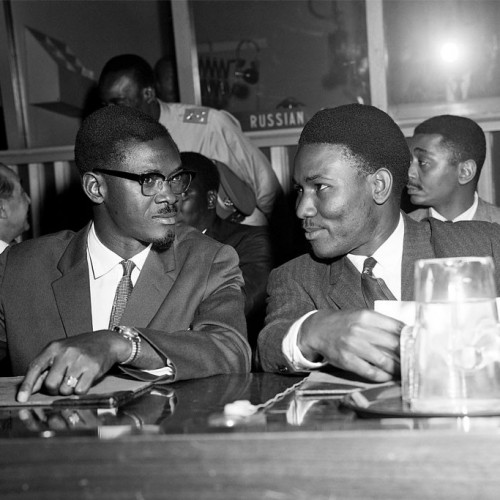

New Imperialism, Capitalism and Global Crises

New Imperialism, Capitalism and Global Crises