Capitalism is a system wracked by internal contradictions that generate crises. Crisis theory attempts to identify these internal contradictions and exactly how and why they generate crises. There is a vast literature and much debate on the nature of capitalist crises, too vast to take up here. But those who approach crisis from the vantage point of Marxist political economy agree on two points: 1 ) crises are immanent to capitalism, that is, crises are "normal" insofar as they are generated by the "normal" functioning of the system; 2) crises are generated by the many interrelated contradictions internal to capitalism, whether posited as the tendency for the rate of profit to fall, as the social antagonism between capital and labor, between use-value and exchange-value, forces and relations of production, value-production and value-realization - posed as the disjuncture between production and circulation, and termed overproduction or underconsumption - or as overaccumulation (overproduction of capital), and so on. I want to focus here on the latter two approaches. henomenon) is the existence of two dimensions inherent in the particular order that are incompatible and that make instability and change an intrinsic part of the order. What is meant by internal is that these contradictions are not anomalies but are part of the very logic of the system, how it functions and is reproduced. In political economy, analysis of the contradictions of capitalism draws on crisis theory and involves a focus on the tendency for the capitalist system to experience recurrent crises. In its political-economy dimensions, the crisis of global capitalism is one of overaccumulation. Capitalism produces vast amount of wealth but also generates social polarization. By definition, capitalists could not generate a profit if the workers who produce wealth were paid for the value of what they produce. Under capitalist production relations, workers produce more goods and services that they are actually able to purchase with their wages. Capitalists would have no incentive to invest their money if the price fetched for the goods and services produced were exactly equal to wages, that is, if they were not assured a profit by appropriating a portion of the value produced by labor in the form of profits (or surplus value, although these two terms are not synonymous). At a certain point, more goods and services are produced than can be purchased by the mass of laborers, and the economy enters a recession or a depression because capitalists cannot "unload" the surplus. This situation of "overproduction" or "underconsumption, " or the "realization problem," means that in order for capitalists to make ("realize") a profit they must actually sell the goods and services produced; otherwise, it simply accumulates and the capitalist loses the money invested in the production process.

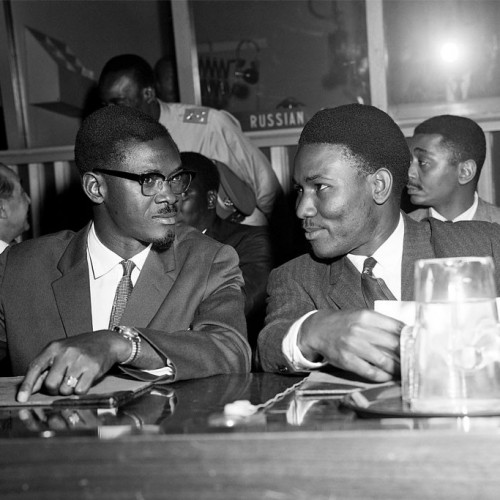

Capitalism and Colonialism: Subjugation of Human Societies

Capitalism and Colonialism: Subjugation of Human Societies